Key Takeaways

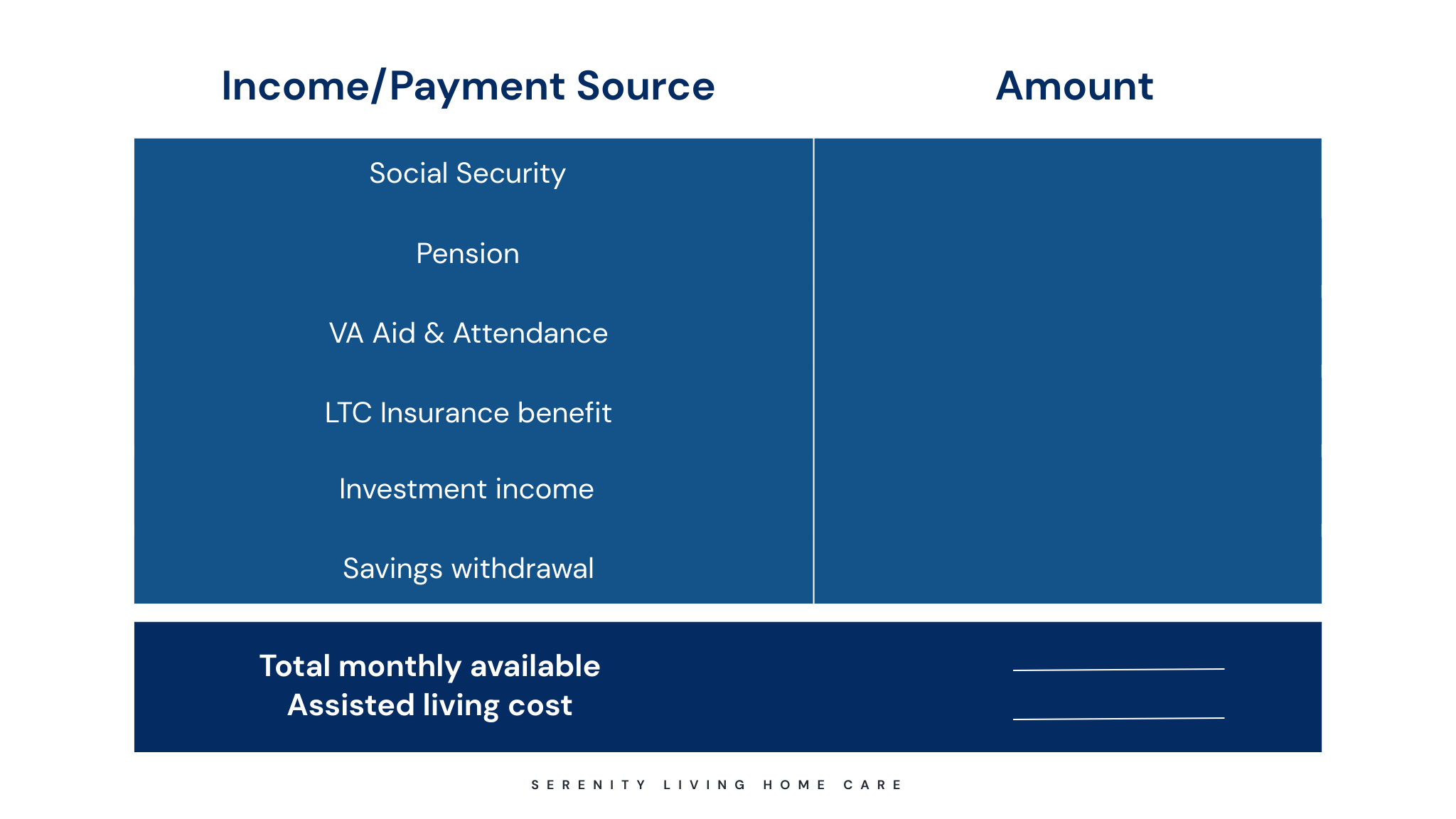

- Families combine savings, insurance, retirement income, and public programs as ways to pay for assisted living costs.

- Medicare doesn’t cover assisted living. Medicaid does if you qualify.

- Plan early to reduce stress and access better care options.

- Most payment strategies involve layering multiple funding sources together.